Do I Need To Change Banks When I Move

There are so many things to consider when you move to a new city or even a new state. You may have already found a place to live, a new job and even scouted out the all-time restaurants in town. But what about your cyberbanking needs? Should you switch banks when you lot move?

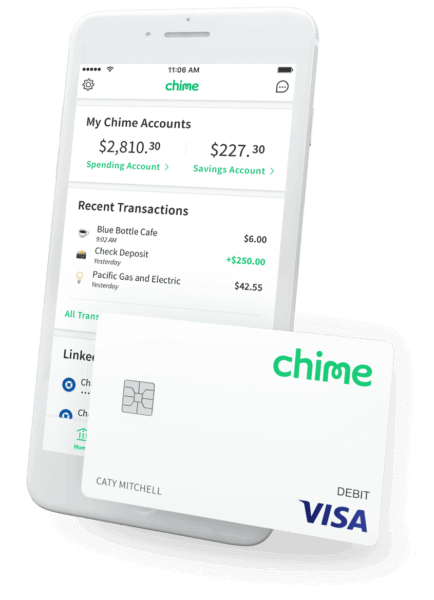

Mobile banking has arrived.

No hidden fees and get paid up to ii days early.

Costless to sign up and takes less than 2-minutes!

Virtually national banks accept simplified the process for you to transfer your accounts to some other branch nearer to your new location. However, that doesn't mean you should automatically stick with your depository financial institution when you're planning to move. Too, you may be moving to a land where your current bank has no branches.

Keep reading to acquire when y'all should and shouldn't switch banks immediately after or during your move. Plus, be sure to check out our moving checklist beneath: the hassle-free way to switch banks.

When Non to Switch Banks During a Move

You're short on time. In the past five years, I have moved four times. During 1 of these moves, I learned that my account with a major national bank was no longer complimentary and that I would be charged $20 a month unless I maintained a bank balance of over $1,500.

Unfortunately, I only had a few days to pack and move to a new state and therefore didn't have the time to inquiry a new bank or go into my co-operative to close my existing account. As a result, I ended up staying with my high fee bank for another few months after my motion.

You need to make a major purchase when you move. If yous're trying to build your credit to authorize for a mortgage or another major purchase when you movement, you might want to initially hold off on opening a new account as it may result in a hard inquiry on your credit score. Again, you might hold off on switching banks until your contract is signed, sealed and delivered.

Your electric current bank is perfect for you. Peradventure y'all've never had any major issues with your bank. And you lot don't want to rock the boat. Yous also may have as well much to bargain with while moving and adopt to stay put with your current bank.

But, what if you're missing out on a ameliorate banking relationship past staying the course? Permit's explore the reasons to switch banks when y'all move.

Reasons to Switch Bank Accounts During a Movement

You desire a fresh start. There's something highly-seasoned about moving and starting afresh – and this includes a new bank business relationship. Now is the perfect time to explore new opportunities to banking company with an institution that actually has your dorsum. There are so many banking options these days that in that location's no reason to stick with your current bank but considering it's not and then bad.

You crave convenience. If yous're cyberbanking with a large national depository financial institution, there'due south a expert take chances there volition be a location in your new hometown, but that may not e'er exist the case. Either way, when was the last fourth dimension you set up foot in a physical branch? Information technology's time to consider switching banks and opening an online banking concern account for the ultimate convenience. Furthermore, because online bank accounts like Chinkle don't take to worry about huge overhead costs, they can focus more on innovation and offer more mod features for their customers.

You're tired of paying high fees. Big banks count on collecting fees to boost their bottom lines. From overdraft, minimum balance to ATM fees and more, the average American pays $329 per year in banking concern fees. But you don't have to pay this cost. If you're been fed up with exorbitant fees, then a clean break from your current bank to 1 that offers low or no fees, may be a skilful idea when y'all move.

Yous desire more. As mentioned above, you may be banking with an establishment that isn't necessarily bad. Simply you may be missing out on many additional perks and incentives that non-traditional banks offering. For case, Chinkle offers an Automatic Savings program that helps you salve coin without having to think virtually it. Each fourth dimension yous make a purchase or pay a bill, Chime rounds up the transaction to the nearest dollar and transfers that amount from your Spending to your Savings account.

Moving Checklist: The Hassle-Free Way to Switch Banks

- Find a new bank that meets all your needs. If you lot're fed up with bank fees, want a better mobile banking experience and need a banking company that actually helps yous reach your financial goals, and then consider a Chinkle account. Chinkle offers a new, innovative, hassle-free mode to banking company. In addition, opening a Chime account only takes a few minutes and can exist done from the mobile app or desktop site.

- Start the process to close your quondam banking concern business relationship. Different banks will probable have different account closing requirements that you need to follow advisedly. Be sure to get out a minor buffer in the account (i.due east. $100-$200) to comprehend any unexpected transactions or banking concern fees like maintenance fees or minimum residue charges that may occur during the transition.

- Update your autopay bills. Make a list of all your bills and determine which ones are currently set up up for autopay. Update all bills with your new bank account information to avoid any late fees.

- Reroute your income. With Chinkle'south Early Straight Deposit, you can get paid upwardly to two days earlier¹ than traditional banks. Your coin is available when your employer sends the funds, giving you peace of mind.

- Residual piece of cake. Now that you've settled in with a depository financial institution that has your back, you can enjoy peace of heed in your new hometown!

This page is for informational purposes merely. Chime does not provide financial, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should non be relied on for financial, legal or accounting advice. You should consult your ain fiscal, legal and bookkeeping advisors earlier engaging in any transaction.

Source: https://www.chime.com/blog/should-you-switch-banks-when-you-move/

Posted by: duranhishentimed.blogspot.com

0 Response to "Do I Need To Change Banks When I Move"

Post a Comment